Osservatorio | October 2024

The German automotive industry is at the end of its run: this is how Germany weighs down the eurozone. ECB forced to rescue.

At a glance:

At the autumn economic test the US passes with flying colours, C hina is delayed in launching its recovery plan and the Eurozone is a lmost in recession, pulled down by Germany and France.

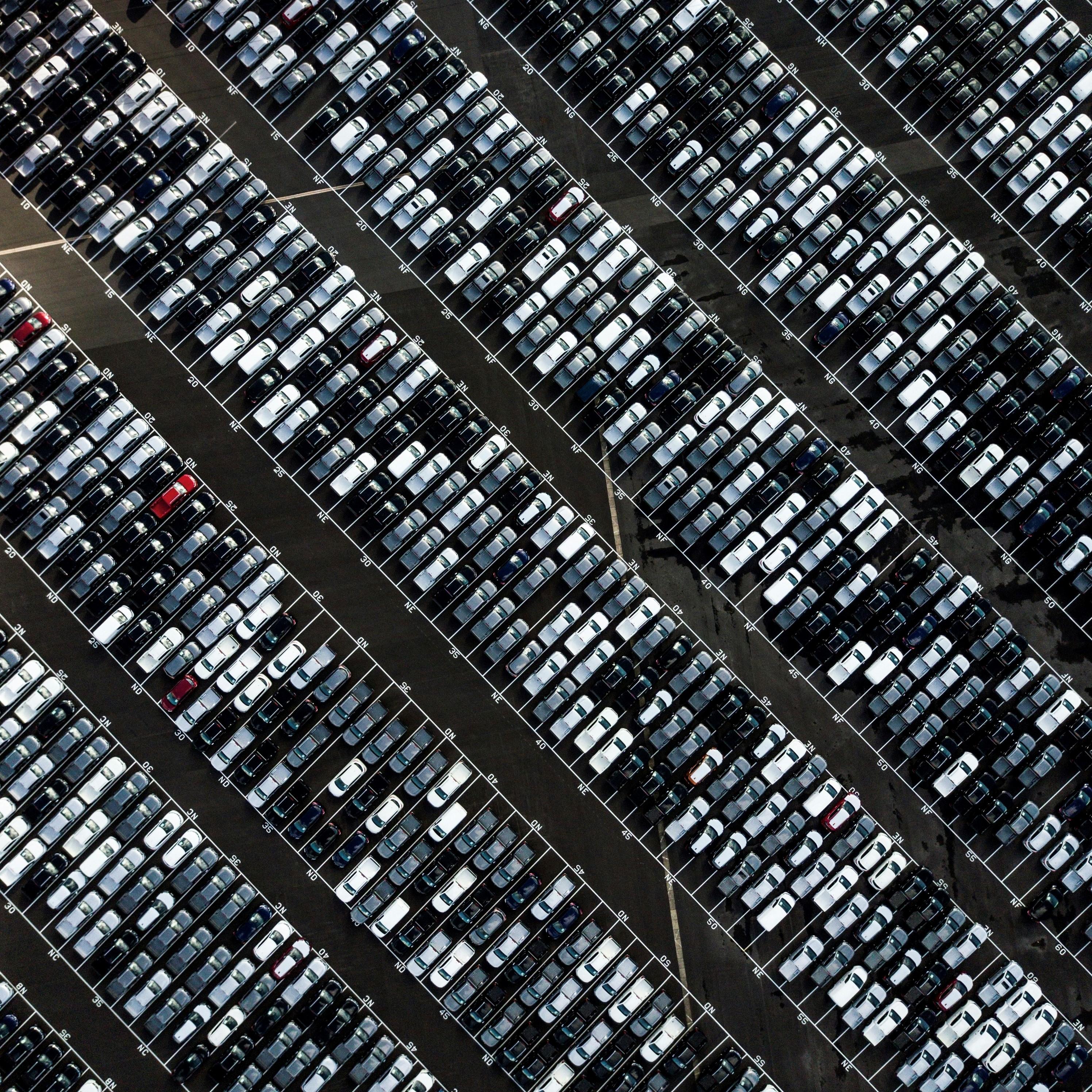

Germany’s car production is still 30 per cent below its 2016 pe ak, just after “dieselgate” forced it to abandon the motorisation i t was banking on, and has become fourth globally, overtaken by China, Japan and India.

Its transition to the electric car, which entails the loss of 6 0 per cent of the value added, compared to the endothermic engine, appears to be stalled: monthly volumes are stuck above 100,000 units, about a third of the total, by the end of 2022.

Italy faces additional challenges, in addition to the weakness of Franco-Germanic demand: reduction of the public deficit; falling investment in housing; lack of workers.

In the US, the employment-consumption pair will not lose steam.

Wage inflation will remain higher due to the strength of the lab our market.

The ECB and the Fed will continue to cut rates, pandering to fa lling inflation. The former will do more than the latter and the euro will suffer.

In an environment of positive nominal and real rates, equity in vestment becomes selective.

Views from the managers: a summary of the insights and observat ions that emerged in meetings with Ceresio Investors’ managers follo wing a recent trip to the United States.